Mobile banking apps have become increasingly popular, providing users with convenient and accessible financial services. Chime, a leading mobile banking app, has revolutionized the banking industry with its user-friendly interface and innovative features. This blog post will guide you through the process of developing a mobile banking app like Chime in 2024. We will explore what Chime is, examine market statistics for mobile banking apps, discuss the development process, and highlight key features to include in your app.

What is Chime?

Chime is a mobile banking app that offers a full suite of financial services to its users. It operates as a neobank, providing digital-only banking services without traditional physical branches. Chime provides features such as mobile check deposit, fee-free banking, early access to direct deposits, and automated savings tools. The app focuses on delivering a seamless user experience and aims to simplify banking for its customers.

Market Statistics for a Mobile Banking App like Chime

Mobile banking apps have gained significant traction in recent years. Here are some market statistics to consider:

-

According to a report by Business Insider Intelligence, the number of mobile banking users worldwide is expected to surpass 3.8 billion by 2024.

-

The COVID-19 pandemic has accelerated the adoption of mobile banking, with more users opting for digital financial services to manage their finances remotely.

-

Millennials and Gen Z are the primary users of mobile banking apps, with a preference for convenience, accessibility, and personalized experiences.

-

Mobile banking apps have seen high engagement rates, with users frequently accessing their accounts for various financial activities.

-

The success of mobile banking apps like Chime can be attributed to their user-centric design, advanced security measures, and integration with other financial tools and platforms.

Also read: Fintech App Development: A Fundamental Guide For Startups

How to Make a Mobile Banking App like Chime?

To develop a mobile banking app like Chime, follow these essential steps:

1. Define Your Value Proposition

Identify your target audience and define the unique value your app will offer. Consider factors like user experience, convenience, and personalized financial tools.

2. Conduct Market Research

Analyze the competition, market trends, and user expectations. Identify opportunities for innovation and differentiation. Understand the regulatory requirements for mobile banking apps in your target market.

3. Build a Strong Tech Infrastructure

Choose a reliable technology stack and develop a robust backend system capable of handling various banking operations securely. Implement features such as user authentication, encryption, and secure data storage. Contact the best ai development company to leverage your app with AI and take advantage of it.

4. User Interface Design

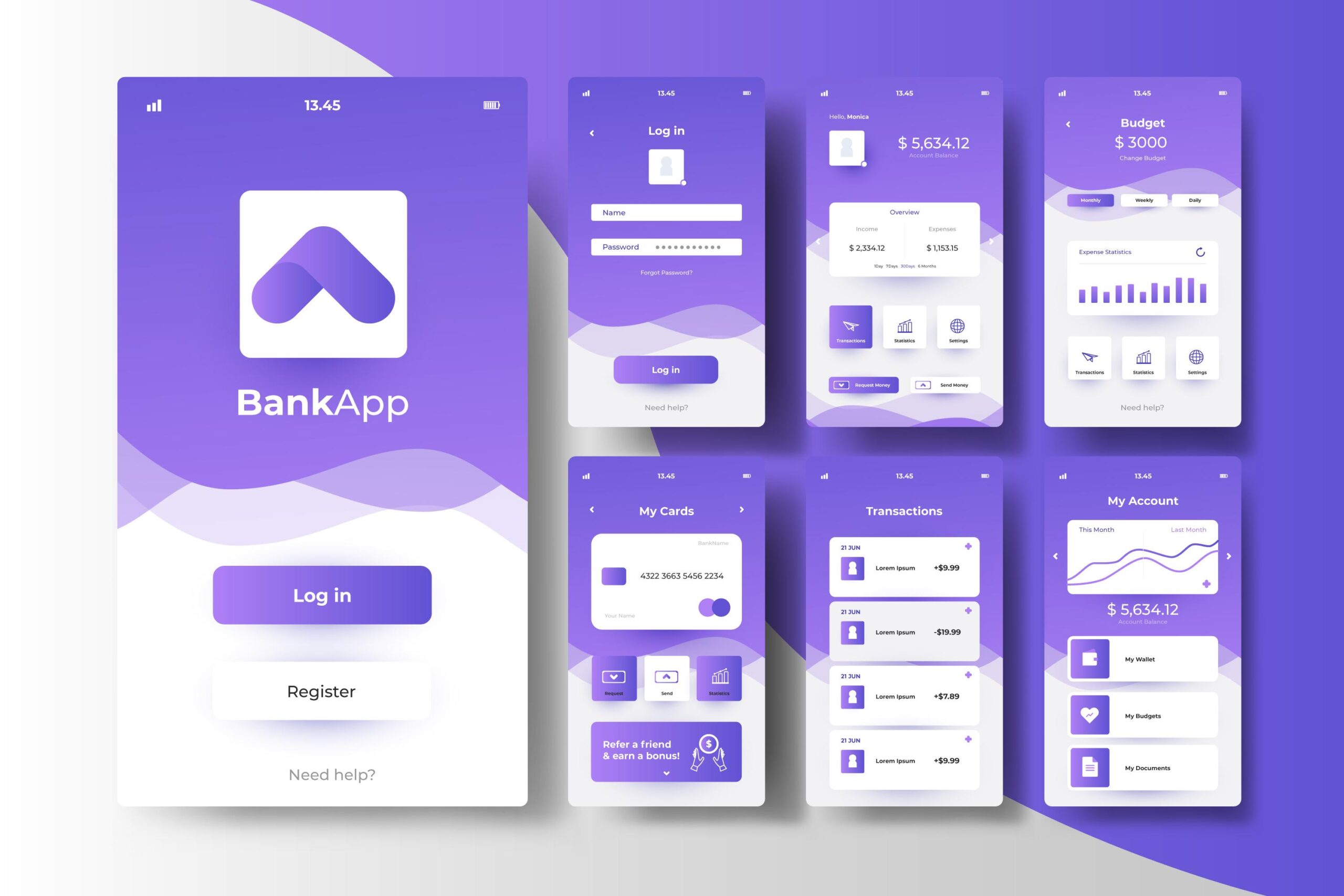

Create an intuitive and visually appealing user interface. Focus on simplicity, ease of use, and seamless navigation. Conduct user testing to refine the design and improve the user experience.

5. Integrations and Partnerships

Collaborate with financial institutions, payment processors, and third-party service providers to integrate essential functionalities such as account creation, deposits, withdrawals, and transfers.

6. Security Measures

Implement advanced security measures to protect user data and transactions. Incorporate features like two-factor authentication, biometric authentication, and transaction monitoring to ensure the safety of user funds.

If you’re interested in fitness app development services, reach out to experienced professionals who can guide you through the process of building a cutting-edge fitness app that will contribute to the ongoing transformation of the fitness industry.

Key Features of a Mobile Banking App like Chime

When developing a mobile banking app like Chime, consider including the following key features:

-

Account Management: Allow users to open accounts, view balances, manage transactions, and access account statements. Provide real-time notifications for account activities.

-

Mobile Check Deposit: Enable users to deposit checks by capturing images through their device’s camera. Automate the check verification and deposit process. You can also hire app developers in India for creating mobile apps.

-

Fee-Free Banking: Offer fee-free banking services for routine transactions such as ATM withdrawals, debit card usage, and account maintenance.

-

Early Access to Direct Deposits: Provide users with early access to their direct deposits, allowing them to access their funds before the official payday.

-

Automated Savings Tools: Offer features that help users save money automatically, such as round-up options, recurring transfers to savings accounts, and goal-based savings.

Conclusion

Developing a mobile banking app like Chime requires careful planning, attention to user needs, and adherence to security and regulatory standards. Wtih the help of financial app development company and by following the steps outlined in this guide and incorporating the key features mentioned, you can create a powerful mobile banking app that provides a seamless banking experience to your customers. Remember to prioritize user experience, security, and continuous improvement based on user feedback. With the right approach and execution, your mobile banking app has the potential to make a significant impact in the financial industry in 2024 and beyond.