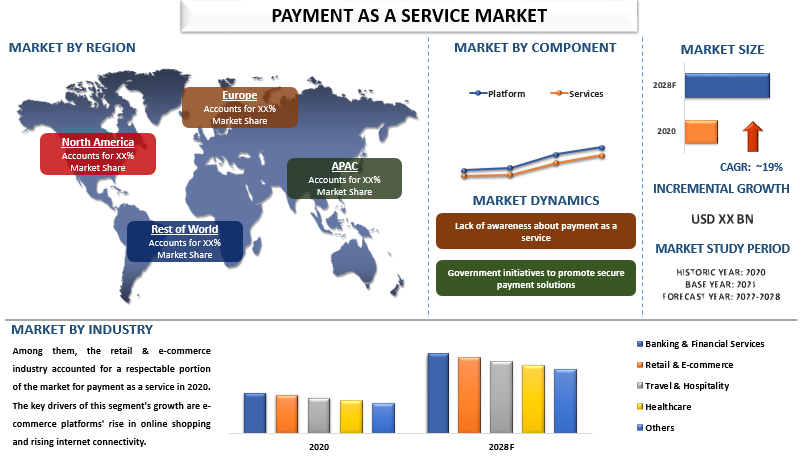

The Payment as a Service Market is on an impressive growth trajectory, projected to achieve a robust Compound Annual Growth Rate (CAGR) of around 19% during the forecast period. This rapid rise can be attributed to the increasing adoption of artificial intelligence-based payment solutions and machine learning in the financial services sector. Payment as a Service, often referred to as PaaS, is a pivotal concept in the realm of financial technology, connecting a diverse array of international payment systems through software as a service.

Access Sample PDF Here- https://univdatos.com/get-a-free-sample-form-php/?product_id=33625

A New Age of Financial Services

Payment as a service represents a transformative approach to financial transactions. It acts as a unifying layer or overlay above disparate payment systems, facilitating seamless bidirectional communication between these systems and payment as a service providers. This innovative platform offers an array of benefits for banks, financial institutions, and organizations across the entire payments value chain. Companies seeking to reduce operating costs, create applications with limited resources, or explore new opportunities find payment as a service an appealing and practical solution.

The Driving Forces Behind the Surge

A multitude of factors fuel the growth of the payment as a service market. The rapidly expanding e-commerce industry plays a pivotal role in this surge. With the convenience of online shopping, the demand for flexible and secure payment methods has skyrocketed. Moreover, substantial investments in cloud computing and artificial intelligence are reshaping the financial landscape. According to the Organization for Economic Co-operation and Development (OECD), global spending on AI is predicted to more than double, growing from USD 50.1 billion in 2020 to over USD 110 billion in 2024.

Browse Research Methodology, Report Description & TOC Here- https://univdatos.com/report/payment-as-a-service-market/

Key Players Shaping the Landscape

Leading the charge in the payment as a service market are prominent players like Fiserv, Inc.; Paysafe Group; VeriFone, Inc.; Ingenico; Agilysys NV LLC.; Alpha Fintech Sdn Bhd; First American Payment Systems, L.P.; Total System Services LLC.; Aurus Inc.; and Paystand, Inc. These industry giants actively engage in mergers, acquisitions, and partnerships to deliver cutting-edge products and technologies to customers.

Insights into the Payment as a Service Market

- Platform Dominance: Within the market, the platform segment is at the forefront, holding a significant share. This is driven by the payment platform’s ability to safeguard consumers’ sensitive payment information, making it a driving force behind the segment’s growth. In the ever-evolving landscape, businesses are increasingly focused on enhancing services and establishing digital platforms to boost sales.

- Retail & E-commerce Influence: In terms of industry, the retail & e-commerce sector emerged as a prominent player in 2020. The surge in online shopping and improved internet connectivity are pivotal factors bolstering this segment. Payment as a service empowers retailers and online merchants to accept payments in a variety of ways, including digital wallets, internet banking, and credit/debit cards.

- Asia-Pacific’s Dominance: The Asia-Pacific region reigns supreme in the payment as a service market, seizing a substantial share in 2020. The regional expansion is attributed to the proactive efforts of governments to promote digitalization and drive the adoption of digital payment technology. The ongoing investments in the e-commerce sector further bolster the local market.

In conclusion, Payment as a Service is revolutionizing the financial services sector, delivering efficiency, security, and flexibility. As we move forward, the adoption of innovative technologies and partnerships will continue to shape the landscape, ushering in a new era of financial transactions.